by admin | Oct 4, 2018 | Uncategorized

The Tax Cuts and Jobs Act (TCJA) was signed into law on Dec. 22, 2017, and represents the most extensive tax reform legislation we’ve seen in 30 years. These sweeping tax law changes impact many taxpayers, including individuals, businesses, estates and trusts. The...

by admin | Sep 17, 2018 | Uncategorized

With wildfire season just behind us and hurricane season upon us, many taxpayers may be wondering if their taxes will be affected by natural disasters. As your clients’ trusted advisor, you can help them understand how they may be impacted, and you can use this...

by admin | Aug 8, 2018 | Uncategorized

WASHINGTON — The Internal Revenue Service issued proposed regulations today for a new provision allowing many owners of sole proprietorships, partnerships, trusts and S corporations to deduct 20 percent of their qualified business income. The New Deduction —...

by admin | Jun 28, 2018 | Uncategorized

As politicians continue to argue over immigration, Supreme Court nominations and whether Putin had a say in U.S. elections, many older Americans just want to know if they are going to be able to afford their health care and medicine. Read...

by admin | Mar 12, 2018 | Uncategorized

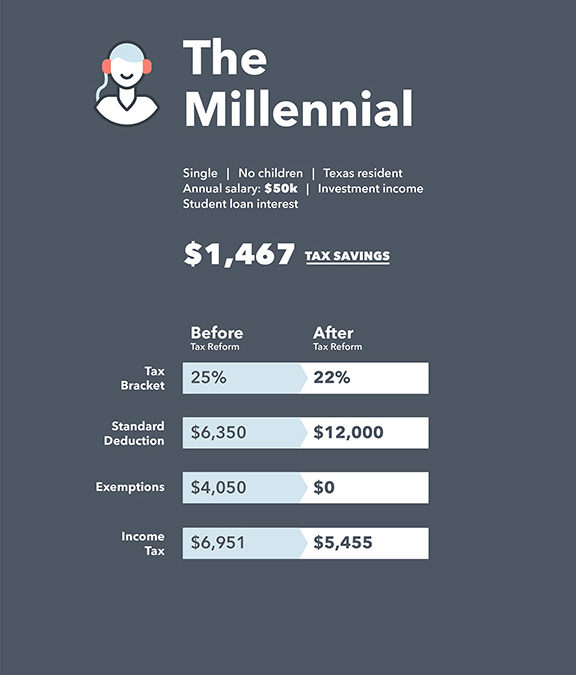

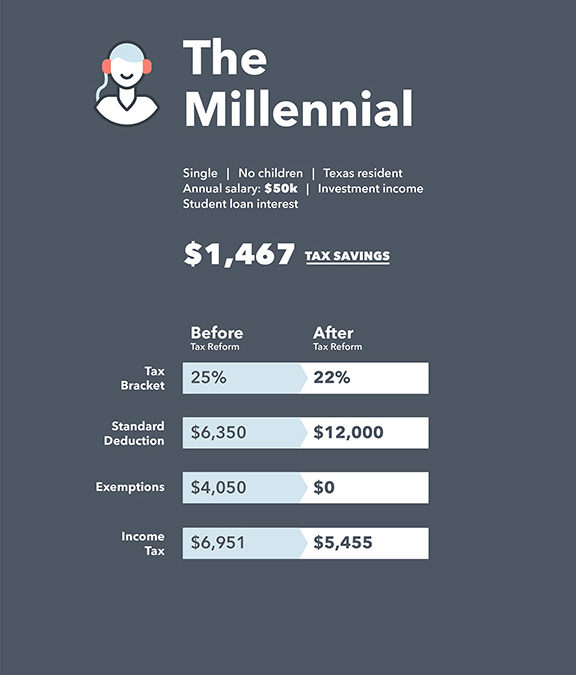

The Tax Cuts and Jobs Act is the largest piece of tax reform legislation in 30 years and was signed into law on Dec. 22, 2017. For most taxpayers, these tax changes impact tax year 2018 and not tax year 2017. Overall, the changes associated with this act will lower...

Email Us

Email Us 470-315-0383

470-315-0383