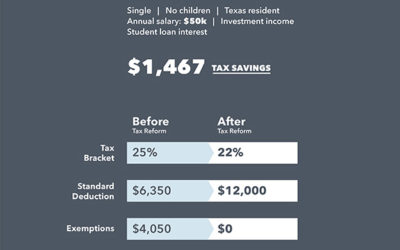

Beginning in 2018, Tax Cuts and Jobs Act (TCJA) will affect many standing provisions, eliminating many of the individual and business deductions, while increasing terms for others; personal exemption deduction, most miscellaneous itemized deductions, job search expenses, hobby losses, etc. have all been eliminated, but there is a significant increase in the standard deduction and child tax credit.

News & Publications

Need tax information? Curious about what changes have taken place for the upcoming year? Well here are a few articles on tax information that will assist you on being more informed. For anything else you need help with, just ask me, I have been doing taxes a long time and have gained surmountable knowledge and experience along the way…..I will share it with you.

Latest News

Tax Reform Makes Changes to the Meals and Entertainment Deduction

The Tax Cuts and Jobs Act (TCJA) was signed into law on Dec. 22, 2017, and represents the most extensive tax reform legislation we’ve seen in 30 years.

read moreCan Your Clients Claim a Natural Disaster Tax Deduction?

With wildfire season just behind us and hurricane season upon us, many taxpayers may be wondering if their taxes will be affected by natural disasters.

read moreIRS issues proposed regulations on new 20 percent deduction for passthrough businesses

Qualified business income includes domestic income from a trade or business. Employee wages, capital gain, interest and dividend income are excluded.

read moreWhat Seniors Need To Know About The Status Of The Affordable Care Act

A customer waits to purchase copies of U.S. President Donald Trump’s fiscal year 2019 budget request, An American Budget, at the U.S. Government Publishing Office (GPO) library in Washington, D.C., U.S., on Monday, Feb. 12, 2018.

read moreTax Reform 101 for Millennials

The Tax Cuts and Jobs Act is the largest piece of tax reform legislation in 30 years and was signed into law on Dec. 22, 2017.

read moreIRS Announces 2018 Tax Rates, Standard Deductions, Exemption Amounts And More

The Internal Revenue Service (IRS) has (finally) announced a number of tax-related provisions for 2018, including, of course, the latest tax tables.

read more

Email Us

Email Us 470-315-0383

470-315-0383