NEWS

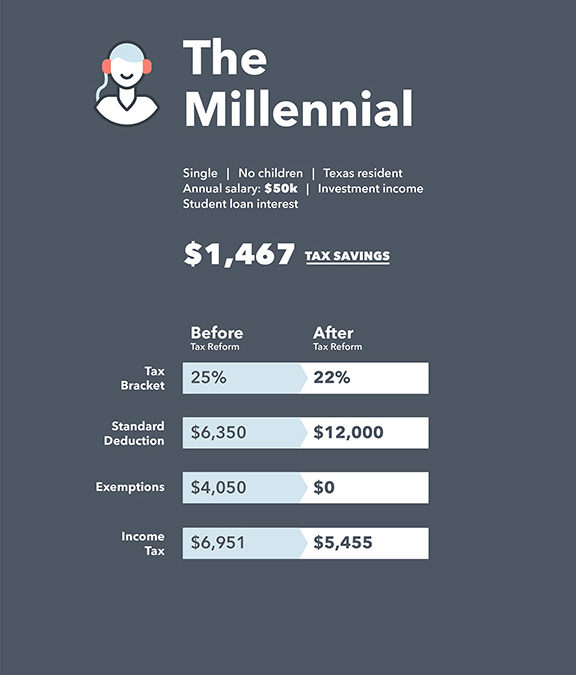

The Tax Cuts and Jobs Act is the largest piece of tax reform legislation in 30 years and was signed into law on Dec. 22, 2017. For most taxpayers, these tax changes impact tax year 2018 and not tax year 2017. Overall, the changes associated with this act will lower taxes for individuals and small businesses.

Although some millennials (those born roughly between 1978 and 1998) work for employers in the traditional sense, many of them tend to embrace the gig economy. This means they may work for themselves on a full-time or part-time (such as an Uber driver) basis. In the eyes of the IRS, self-employed people are treated as small business owners.

Email Us

Email Us 470-315-0383

470-315-0383